NVIDIA, a name that resonates with innovation and progress in the tech industry, has been making headlines as its stock has soared, culminating in an unprecedented closing price nearing $500 on November 14th. This remarkable ascent is not merely a statistical anomaly; it represents the culmination of over ten consecutive days of growth, underscoring the company’s dominant position in the semiconductor landscape.

The numbers tell a compelling story—NVIDIA's year-to-date stock increase stands at an impressive 240%. In comparison, the combined stock growth of tech giants like Amazon, Microsoft, Google, and even Apple pales in comparison, revealing NVIDIA's formidable presence. For context, the Nasdaq 100 index has only increased by 55% during the same period. With a market valuation that surpasses $1.2 trillion, NVIDIA currently eclipses the total market capitalization of major players like AMD, Intel, Qualcomm, Broadcom, and ASML, solidifying its status as the king of the semiconductor realm.

This moment in AI is likened to the "iPhone moment."

"He who has the computational power holds the world."

In the past, NVIDIA basked in the glory of its gaming graphics cards, thriving in the cryptocurrency mining buzz, and capitalizing on remote working and metaverse trends. However, the company faced substantial challenges in 2022 due to a difficult macroeconomic environment. Yet, 2023 heralds a resurgence led by the generative AI movement, with data centers emerging as the company’s linchpin. This pivot not only weathered the semiconductor industry's downturn but catapulted NVIDIA back to the pinnacle of success.

The foundation for NVIDIA's timely positioning stems from its forward-looking vision. Back in 2016, NVIDIA's founder Jensen Huang declared the company was no longer just a semiconductor company but had transformed into an AI computing entity. This foresight allowed NVIDIA to consider "computational power" as the essential element of artificial intelligence long before the current fervor overtook the tech landscape. At its core, this computational power was built through platforms like CUDA, dedicated GPUs for data centers, and extensive software libraries, all strategically designed to await what Huang referred to as the AI's "iPhone moment."

That moment has finally come, notably thanks to the emergence of ChatGPT—a symbol of generative AI's groundbreaking impact on the industry.

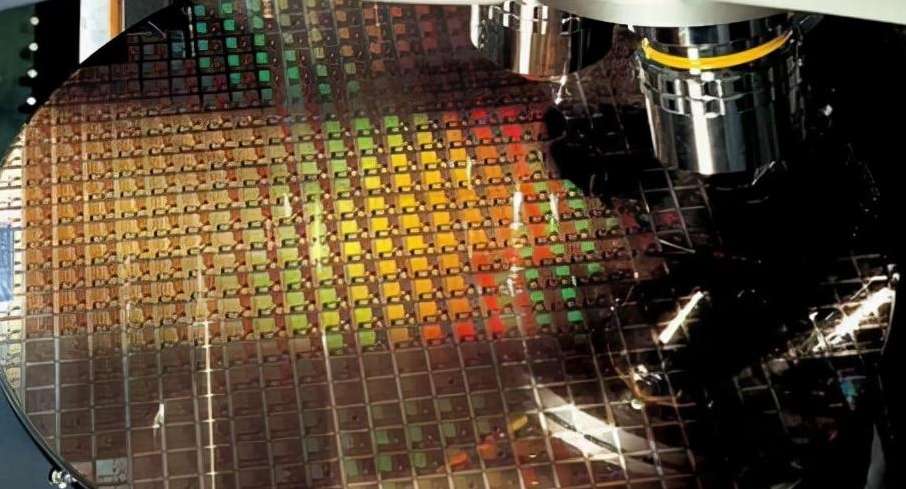

As AI models grow in complexity, the requirements for training and deployment have skyrocketed, subsequently driving an insatiable demand for AI chips, specifically high-performance GPUs. NVIDIA has been astutely preparing for this explosion, commandeering an impressive 80-90% share of the global market. Their ace in the hole lies in the A100 and H100 chips (with the H200 slated for release in the second quarter of next year). Major cloud service providers and numerous tech companies have been scrambling to acquire NVIDIA chips at any cost to meet the burgeoning computational demands of the AI age.

While the spotlight shines brightly on large language models and cloud service providers, NVIDIA—the entity providing the very infrastructure—has emerged as the primary beneficiary. Throughout this evolution, NVIDIA has adeptly transformed from a GPU vendor to a renowned leader in the realm of AI computing, justifying its remarkable stock performance this year.

A forward P/E ratio of less than 30 indicates robust market expectations.

The market anticipates high-speed profits growth in the upcoming year.

NVIDIA's skyrocketing share price and market value can be attributed to explosive earnings growth. By the second quarter ending July 30, 2023 (falling within its fiscal year covering January 30 to January 29), NVIDIA reported revenues of $13.51 billion—a staggering 88% increase quarter-over-quarter and a 101% year-over-year surge. The net profit for the quarter hit $6.188 billion, reflecting an astronomical 843% year-on-year increase!

Contributing significantly was the data center business, which boasted a quarterly revenue record of $10.32 billion—an increase of 141% from the previous quarter and 171% year-over-year. This vital sector accounted for 77% of the company’s total revenue, up from just 35% in the prior year, clearly outpacing gaming’s 19%, professional visualization’s 3%, and autonomous driving’s 2%.

However, NVIDIA's price-to-earnings ratio nearing 120 has left some investors hesitating. Behind this high valuation, capital markets speculate on immense growth potential stemming from skyrocketing revenue and profit margin rise. Analyzing over the last three years until July, NVIDIA's average revenue growth rate reached 34.5%, comfortably outperforming its peers (where AMD's corresponding 35.7% growth equated to a staggering 1000-fold P/E). Moreover, the company's gross and net profit margins reached historic highs of 70% and 46% respectively, reflecting an impressive return on equity of 95.2%—also a record.

Financial institution Raymond James estimates that the cost for H100 chips is only $3,320, resulting in profit margins potentially reaching 1000%! Training large language models typically involves deploying thousands of H100 clusters, with market projections estimating 500,000 H100 units to be sold in 2023, cumulatively worth billions, despite the ongoing supply shortage.

As revenue derived from software services escalates, NVIDIA's overall profit margins are anticipated to climb further. Interestingly, while the gaming business has stepped back internally, its revenue and growth have revived for two consecutive quarters, hinting that the sector may finally be on an upward trajectory after its lowest point.

For the next twelve months, NVIDIA's expected P/E ratio remains below 30—similar to AMD—indicating the market's anticipation of sustained high growth in profits in the coming year.

Forecasts suggest the global AI sector’s market capitalization could skyrocket from the current hundreds of billions to a staggering $2 trillion by 2030. This paradigm shift represents a transition from traditional CPU-based computing to GPU-accelerated computing, highlighting NVIDIA's indomitable position as the "shovel seller" in the gold rush that is AI.

Clients are becoming competitors.

The "shovel seller" has now joined the "gold diggers."

In a bid to avoid the so-called "NVIDIA tax," giants like Google, Amazon, and Microsoft have embarked on developing their own self-made AI chips. This trend signals that NVIDIA's largest clients might evolve into future competitors, potentially challenging NVIDIA's monopoly.

Nonetheless, NVIDIA is not merely sitting idly. In March, NVIDIA announced DGX Cloud, marking its entry into the traditionally bounded realm of cloud computing dominated by tech titans. This transition indicates that the "shovel seller" is now stepping into the "gold digging" arena, enduring competition and transformation within the AI age.

DGX Cloud, offering not just hardware but also two accompanying software platforms, enables clients to access NVIDIA's AI products and services either directly from the cloud or their local data centers. Furthermore, NVIDIA has invested in numerous startups to bolster its influence in both large model and cloud service sectors while engaging with enterprise clients to boost software sales revenue.

Constant challenges loom ahead for NVIDIA, chiefly regarding supply constraints from TSMC, which might impact the delivery of high-performance GPUs. This necessity underscores NVIDIA’s pursuit of additional foundry collaborations.

The evolving U.S.-China relationship also casts an uncertain shadow on the company’s performance. Currently, the Chinese market accounts for approximately 20% of NVIDIA’s total revenue; easing export restrictions could yield exponential growth.

Projected Q3 earnings growth of 170%.

A broadly optimistic mid to long-term stock outlook.

In the backdrop of waning geopolitical risks and improving interest rate prospect, alongside stock performances (including NVIDIA and Microsoft hitting historical highs), the Nasdaq index is poised to reclaim its historical peak—currently just a 6% distance away. Sustaining three consecutive weeks of gains may further amplify market optimism. NVIDIA's financial report next week could serve as a pivotal catalyst.

Scheduled for release on November 21, NVIDIA's Q3 financial report is anticipated to illustrate a staggering 170% year-on-year revenue growth, expected to reach $16 billion. However, it's vital to acknowledge the heightened market expectations; if performance falls short, a short-term market correction may ensue. Nonetheless, the impact of a single quarterly report is unlikely to undermine the company’s overarching mid to long-term positive outlook.

According to Tipranks, among 38 analysts who issued reports on NVIDIA over the past three months, 37 have rated it as a "buy," and one as "hold," with an average target price of $647 for the upcoming year, indicating a potential upside of about 32% from current levels, while the highest price target reaches $1,100.

In the second quarter of fiscal year 2024, the company returned a total of $3.38 billion to shareholders, and on August 21, the board approved an additional $25 billion for stock buybacks.

(The views expressed in this article are solely those of the author and do not reflect the position of this publication. The stocks mentioned are analyzed solely for reference and do not constitute investment advice.)